Displaying items by tag: XPS

Transfer values fluctuate but end January unchanged

XPS Pensions Group makes new senior hire

Xafinity SIPP/SSAS reports £86m commercial property transactions

XPS Pensions backs CDC pension proposal with caveats

In November, the DWP detailed its plans for the new type of occupational pension scheme which will be subject to a 0.75% charge cap with the aim of keeping costs down. Royal Mail is already looking at introducing a CDC.

The government gave the green light last year for CDCs and plans to legislate for them in due course although critics have already warned it could take years for CDCs to arrive and they may risk fluctuating income for members in retirement because of their structure.

XPS says in its submission to the government on the proposal to introduce CDCs that they could provide “better outcomes” for employees than traditional DC schemes.

However, it said they may take choice away from members and present additional risks so it is “critical they are well designed and managed.”

XPS Pensions Group says there are three key areas the DWP and Pensions Regulator will need to consider to ensure the development of a successful CDC framework. These include:

1. Sustainability and resilience of CDC schemes for the future

2. How to ensure fairness of outcomes between generations

3. Member understanding and expectation

Consultation on CDCs ended last week.

Jacqui Woodward, senior consultant at XPS Pensions Group said: “In our view it will be possible to develop an appropriate disclosure framework that adequately communicates CDC benefits to members.

“However, we would caution against underestimating the risks of CDC schemes in the rush to get them established. It is worth taking time to make sure that the new types of scheme can offer a genuine and safe alternative to members and we look forward to providing our input to further consultations on the detailed design of CDC arrangements.”

Xafinity SIPP grows but warns sector is standing on a 'precipice'

Xafinity owner buys pension firm and sells healthcare arm

XPS Pensions Group, owner of the Xafinity SIPP and SSAS business, is acquiring police pensions specialist Kier Pensions from Kier Business Services for £3.5m in a double deal.

At the same time as the acquisition of Kier Pensions, the company is selling its Healthcare Consulting Business to Punter Southall Health and Protection for £1.25m in cash.

The company says the transactions will “further strengthen the company’s strategic focus.”

Kier Pensions provides third party pension admin to public sector clients, including approximately half of the police forces in the UK, according to XPS.

The deal adds to XPS’s pensions administration business, XPS Administration, and gives XPS for the first time a presence in the public sector third party administration market.

Kier Pensions Unit, part of Kier Business Services, a division of Kier Group, will be acquired for a total of up to £3.5 million in cash.

XPS’ Healthcare Consulting Business provides consulting services to companies involved in healthcare benefits for employees and will be sold to Punter Southall Health and Protection, a subsidiary of Punter Southall Group, for an estimated £1.25 million in cash.

Paul Cuff, co-CEO of XPS Pensions Group, said: “We are delighted to announce these two deals today. They are both consistent with our strategic focus on our core market of workplace pensions.

“The acquisition of the Kier Pensions Unit will add to our strength in the pensions administration market and has the potential to open up new opportunities in the public sector. Meanwhile we are pleased to find a good home for colleagues in our small Healthcare Consulting business, where we expect them to thrive in the future, whilst we focus relentlessly on what we do best.”

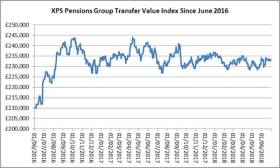

Pension transfer values dip in June - XPS index

Pension transfer values - as measured by the XPS Pensions Group Transfer Value Index - fluctuated “mildly” during June 2018 with a small fall during the month, says the firm.

The index was £234,000 at the end of May and £233,000 at the end of June.

The difference between maximum and minimum readings of the Transfer Value Index over June was £4,400 (or around 1.9%).

The index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (increasing each year in line with inflation).

XPS points out that different schemes calculate transfer values in different ways so a given individual may therefore receive a transfer value from their scheme that is “significantly different” from that quoted by the index.

Sankar Mahalingham, head of DB Growth, XPS Pensions Group, said: “Transfer values have been stable over the first half of 2018, during which the Index has fluctuated by only £8,300 (or around 3.6%).

“If we compare this to 2017, when in both halves of the year the index fluctuated by £14,000 (or around 6%), we can see that although transfer values remain close to historic highs in 2018, there has been a notable reduction in volatility.

“Given the recent UK political upheaval and its potential impact on the approach to Brexit, coupled with the changing global political climate (for instance in relation to possible escalation of trade wars), it remains to be seen whether this low volatility in markets and transfer values will continue over the coming months.”

XPS Pensions Group claims to be the largest pure pensions consultancy in the UK, specialising in pensions actuarial, investment consulting and administration, with revenues of over £110 million. The parent company is also a significant SIPP provider.

The company works with over 1,200 pension schemes, including 25 with over £1bn of assets, and undertakes pensions administration for over 600,000 scheme members.