Displaying items by tag: Xafinity

Xafinity SIPP and SSAS rebrands as XPS

Xafinity SIPP and SSAS has rebranded as XPS Self Invested Pensions following the creation of XPS Pensions Group three years ago when Xafinity acquired the actuarial and administration divisions of Punter Southall.

Xafinity SIPP/SSAS tops 2,000 commercial properties

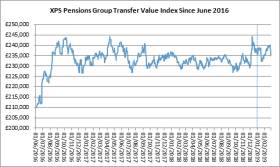

Xafinity owner launches monthly pension Transfer Watch report

Transfer values rise £5k in Feb but then fall back

Xafinity cuts fees on SimplySIPP product

Xafinity SIPP/SSAS reports £86m commercial property transactions

Xafinity SIPP grows but warns sector is standing on a 'precipice'

Xafinity owner buys pension firm and sells healthcare arm

XPS Pensions Group, owner of the Xafinity SIPP and SSAS business, is acquiring police pensions specialist Kier Pensions from Kier Business Services for £3.5m in a double deal.

At the same time as the acquisition of Kier Pensions, the company is selling its Healthcare Consulting Business to Punter Southall Health and Protection for £1.25m in cash.

The company says the transactions will “further strengthen the company’s strategic focus.”

Kier Pensions provides third party pension admin to public sector clients, including approximately half of the police forces in the UK, according to XPS.

The deal adds to XPS’s pensions administration business, XPS Administration, and gives XPS for the first time a presence in the public sector third party administration market.

Kier Pensions Unit, part of Kier Business Services, a division of Kier Group, will be acquired for a total of up to £3.5 million in cash.

XPS’ Healthcare Consulting Business provides consulting services to companies involved in healthcare benefits for employees and will be sold to Punter Southall Health and Protection, a subsidiary of Punter Southall Group, for an estimated £1.25 million in cash.

Paul Cuff, co-CEO of XPS Pensions Group, said: “We are delighted to announce these two deals today. They are both consistent with our strategic focus on our core market of workplace pensions.

“The acquisition of the Kier Pensions Unit will add to our strength in the pensions administration market and has the potential to open up new opportunities in the public sector. Meanwhile we are pleased to find a good home for colleagues in our small Healthcare Consulting business, where we expect them to thrive in the future, whilst we focus relentlessly on what we do best.”